Features of Quarterly

Express Plus

- Quarterly Express Plus is Windows

compatible (XP,7,8,10 etc) and comes with a very simple installation process.

- Allows Business Taxpayers,

ERO's and Reporting Agents to quickly complete Business Tax Returns and submit them for

e-file.

- Quarterly Express

currently supports the following forms:

-

- Payroll Tax Forms

: 941, Schedule B, Schedule R, Annual 940, 943, 944 and 945 forms.

- Excise Tax Forms :

720, Schedule A, Schedule C, Schedule T, Form 6197, and Form 6627

- Excise Tax Forms : 2290, Schedule 1

- Excise Tax Froms : 8849, Schedule 1, 2, 3, 5, 6, 8.

- State Tax Forms : NYS-1 and NYS-45

- ACA Forms : 1094-B, 1094-C, 1095-B, 1095-C

- Quarterly Express limits

your data input by copying the company information into each return after

creation.

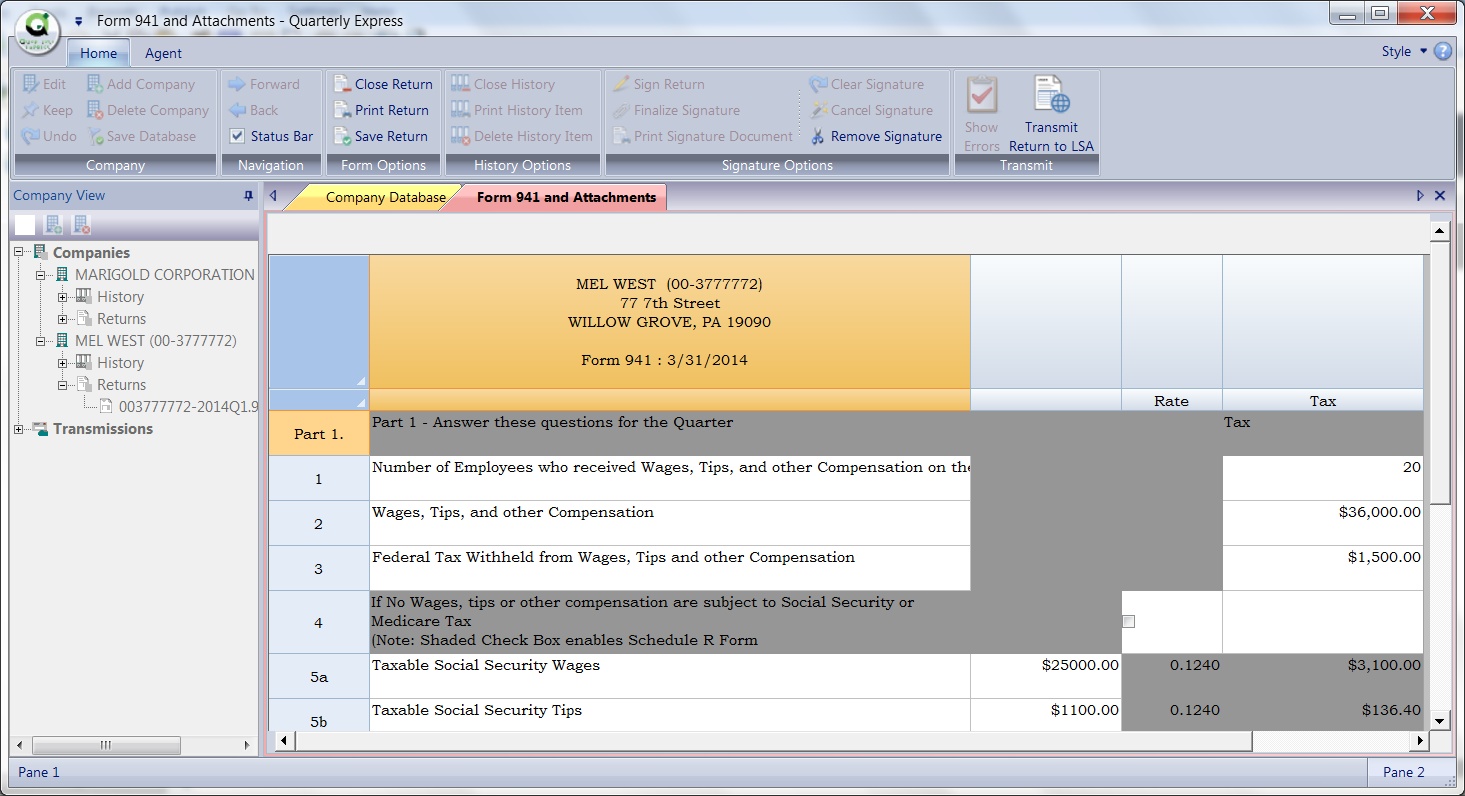

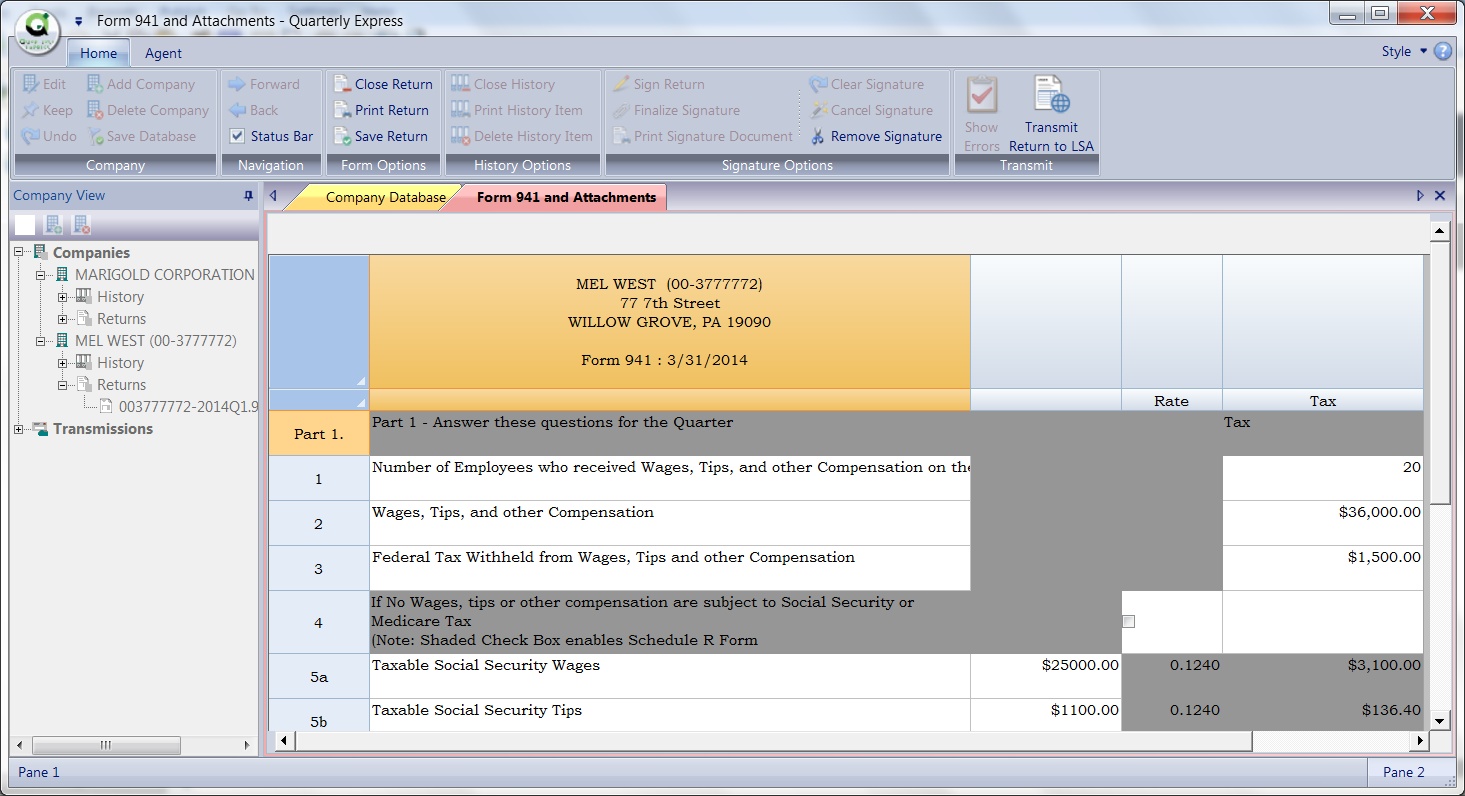

- Quarterly Express will

automatically calculate the return. You only enter uncalculated numbers into the software during

preparation.

- Quarterly Express fully

interfaces with the IRS MeF System for both Payroll and Excise Taxes.

- Quarterly Express Plus

supports the AIR System for e-filing of ACA Forms.

- Supports an Indirect

method for filing for Business Taxpayers, ERO's and Reporting Agents.

- Supports a Direct method

of filing for Reporting Agents, and other tax professionals who have the capability and

access.

- Allows for the submission

of signed returns using our signature capture capability that will not require scanning of

documents.

- The software will provide printed copies of all returns completed within the

product.

|